Thinking About Refinancing?

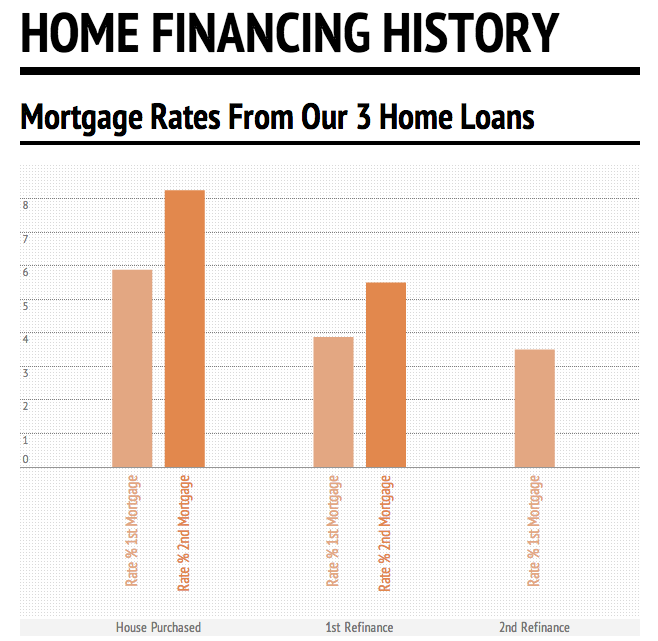

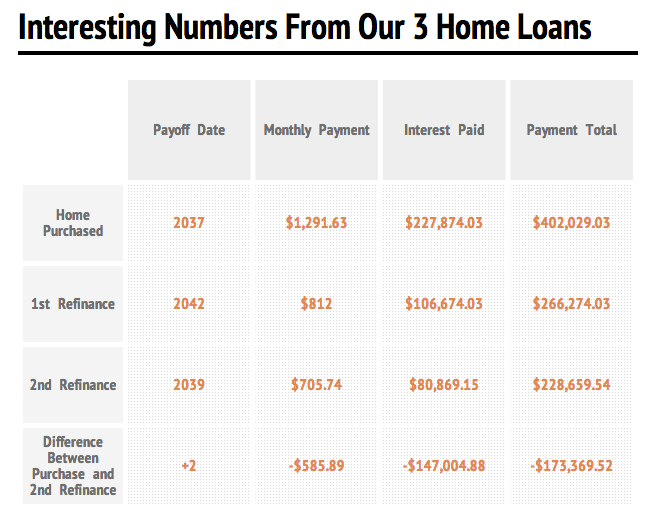

Last week we refinanced our house for the second time since Rooney was born. The first time was when she was less than a week old. We had already set the date for closing and Rooney decided she wanted to see the world before her due date...kids! A friend recommended a small local bank (Luana Savings Bank) that allowed us to refinance both times with no out-of-pocket costs. I'm still trying to figure out why they do this and what their catch is... Buying a house before we were ready is filed under stupid tax, so after weighing our options, refinancing was the best option for us at the time. Having recently filed our taxes, it was reassuring to see that in 2012 we paid $4,000 less in mortgage interest than we did in 2011. That is a lot of money! Here are a few charts that look at the three different scenarios that we have experienced with our mortgage. I think they paint a pretty picture of the amount of money we will save over the long haul.

It's no secret that interests rates for home buyers are at an all-time low. They will also probably continue to stay low for the foreseeable future. So, if you can find a bank that offers no closing costs or other out-of-pocket expenses for you to refinance, it's really a no-brainer. That is... a no-brainer with a lot of paperwork.

The worst part for us was that our appraisal last year came in significantly lower than what we had hoped. We had lost nearly $30,000 in value since purchasing five years earlier. Our problem was that we bought a new home right before the housing market crashed and home values were sky high. There seems to be hope that they are on the rise again, but because our value dropped, we had to take out a second mortgage at a higher rate when we refinanced. Fortunately, the amount was only $10,000 and we paid it off this last year.

Ideal Situation (If We Had a Do-Over)

In a perfect world, and by Dave Ramsey's recommendation, we would have waited to buy a home until we could put 20% down and afford a 15-year mortgage that would be no more than 25% of our take home pay. Unfortunately we didn't know any better when we purchased our home (we hadn't taken FPU yet) and so refinancing has become the band-aid to make the best of the situation. Of course we would have loved to refinance to a 15-year loan, but that would have increased our monthly payment by more than $300 and also move our housing budget well beyond 25% (when we first purchased our home, it was 32%).

Ideal situations don't always present themselves in real life. It might be one of the biggest lessons we've learned in our financial lives. Try as we might, we won't always make the best decision in the moment. We just hope to learn from our mistakes along the way.

Refinancing

If you are thinking of refinancing, you'll want to consider the costs involved and how long it will take to get your money back. Next, weigh that against how long you plan to stay in your current home. If you decide to sell, you'll likely have realtor fees to figure in, so selling in the short term definitely hinders your likelihood of getting your money back. You can calculate how long it will take you to make your money back with this handy worksheet at federalreserve.gov.

If you've determined that it's going to be worth it, here are two angles to approach refinancing.

- Monthly Payment: When we refinanced the first time, we of course wanted a better interest rate, but because we were also having a baby, we wanted extra money every month to offset some of the expenses that come with having a baby. See our savings below! (We also saved money by paying of the second mortgage after our first refinance.)

- Term of the Loan: The second time we refinanced, we knew we could get a little better interest rate and that it could decrease our monthly payment, but this time we didn't want to decrease our monthly payment, we wanted it to stay the same. So, I used mortgagecalculator.org to figure out the years we could shave off our loan and roughly keep our payment the same. You can also use Zillow's mortgage calculator. It seems to a little more user-friendly.

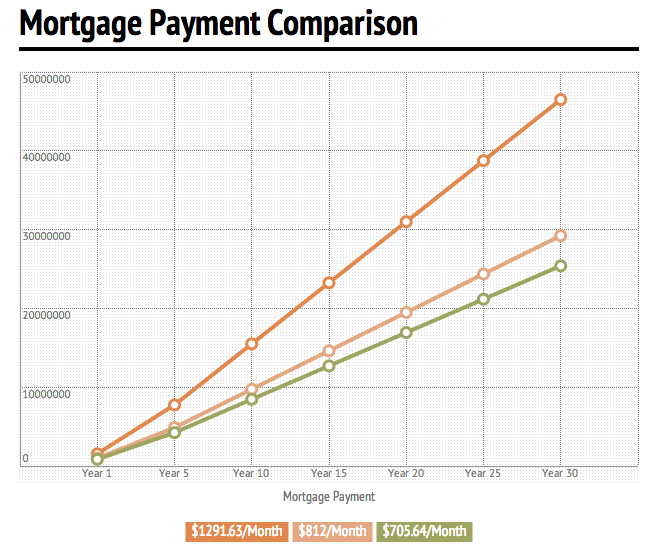

This next chart shows what our total amount paid toward our home would have been if we carried out the life of the original loan and made the same monthly payment for 30 years. I'm a visual person, and it really helps to know how much we are saving in the long run. It's easy to get caught up thinking that you'll always have a mortgage payment and just pay the bill every month. But small changes can have big impacts in the scope of 30 years.

My hope in all this rambling is that you gain a better understanding of the moving pieces to your mortgage. It's likely the biggest investment/purchase you will ever make. To take it lightly would not be wise. We certainly learned the hard way. We both wish we would have waited a little longer so we could have come closer to the ideal situation as described above. (But don't get us wrong, we love our house!)

We do have full intentions of developing a strategy to make extra principal payments over the next few years. And we have zero intentions of riding this mortgage out for the full term. We should be focusing on baby step 6 (paying off the home early) in the next few months after we get baby steps 4 and 5 rolling. We couldn't be more excited!

What's your wise advice when it comes to mortgages?

P.S. I used infogr.am to create the images above. I had to take screenshots though because the iframe function wasn't working.