YNAB Budgeting Rule #2: Save for a Rainy Day

You Need a Budget's (YNAB) Rule One told us how to give every dollar a job. Rule Two tells us to "save for a rainy day." it's something I remember hearing old people say when I was younger, yet never really knew what it meant. Why save for a rainy day? Typically rainy days meant staying inside and not doing much of anything, let alone spending money. So, why save for that? Perhaps a way too literal interpretation of the saying...

YNAB uses this idea to help us understand how to save for big expenses that do not occur monthly. For example: car insurance, life insurance, Christmas, vacations and vehicle registration.

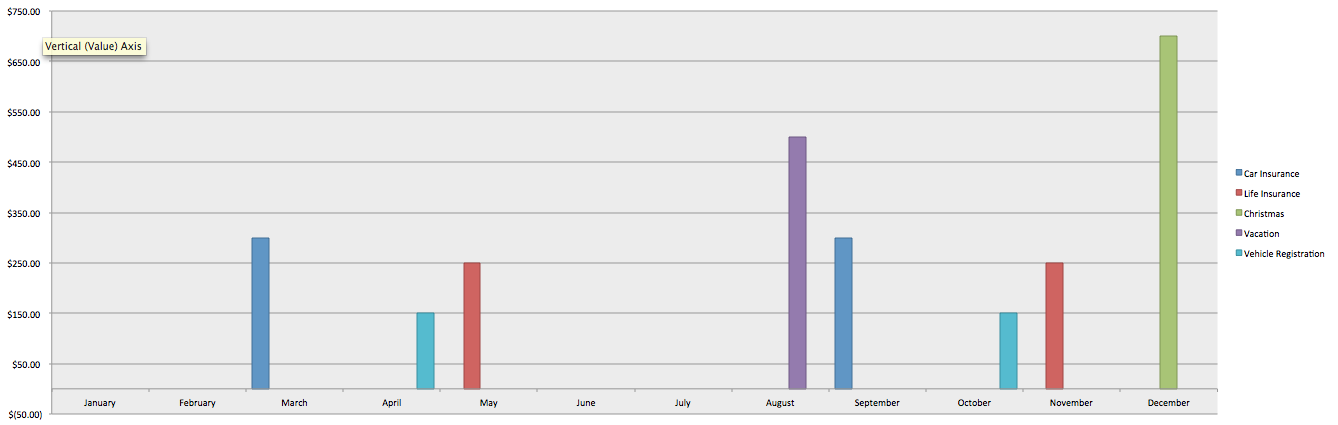

I thought it would be helpful to see this in action. So, let's take a look at a scenario of spending for these categories, if you were to just pay for them as they came up. (These numbers are fairly close to what we spend per year for these items.)

In the example above, you can see we have irregular payments eight times a year of at least $150. Remember that we also have our regular monthly expenses to pay for during those months, and if we're not saving up for these "rainy day" categories, when these months come it can be very tough (for most average-income-earning folk) to cover the expenses without a lot of stress. And stress of paying bills or paying for expenses when you don't have the money or a plan can certainly spill over into other areas of your life.

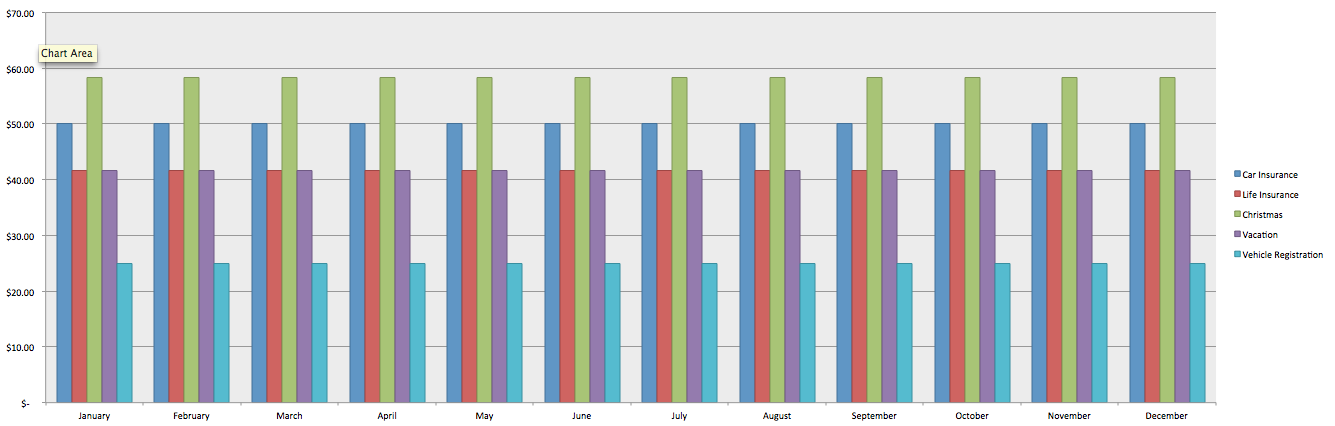

So, let's look at a way to avoid those huge spikes in monthly expenses by spreading out the savings for these five categories. This chart shows how much you would have to save each month if you spread each cost over one year.

By taking the total amount spent in each category and dividing it by 12 (months in a year), I get the monthly average for each rainy day category. So, for instance, car insurance costs me $600 per year (two $300 payments made every six months). $600 / 12 months = $50/month. Finding $50 per month to save with a "set it and forget it" mentality can do a world of good in reducing the stress of finding $300 every six months.

You can do this with as many irregular expense items you can think of. It's really simple math, but saves a multitude of stress. We apply this thinking as soon as we know of an expense coming up in the future. Most recently, when we decided we were going to take family photos this fall, and when we decided we were going to the TxSC conference.

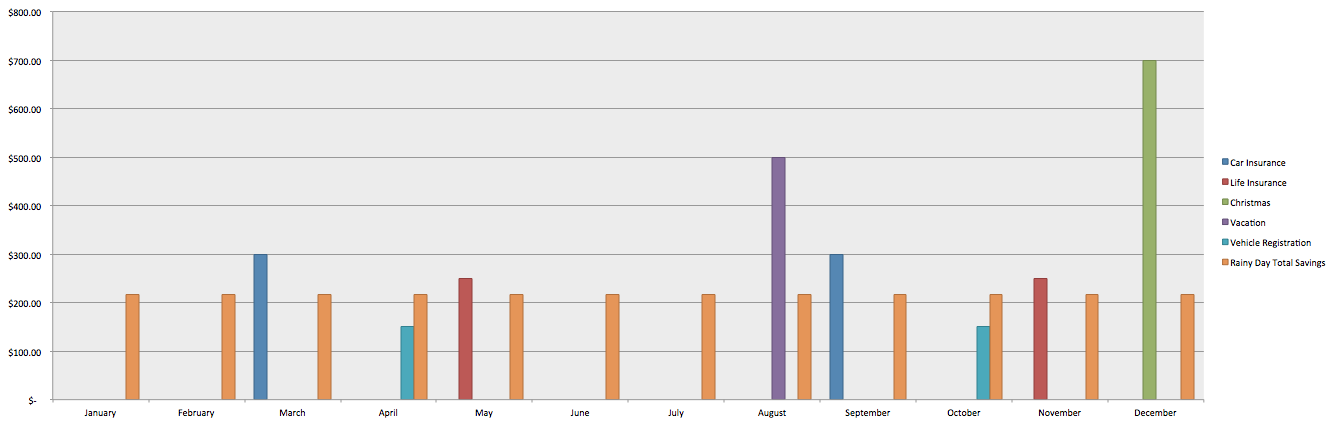

Now let's look at combining the first two examples for perspective. The orange shows the monthly average and the other colors show the costs broken out as they are due.

If you add up the monthly savings needed for all of the categories listed, it comes out to $216.53 per month. It may sound like a lot to save every month, but remember, this is the responsible way to make sure we aren't scrambling when these things come up.

How hard is it to find $600-700 for Christmas gifts for the family if you haven't saved for them all year? We used to do that, and it felt horrible and gave us a bad taste in our mouth about the most joyful season of the year. Giving should be fun, and it can be when you save for it.

If you can find the money each month to save for these items, it's a guaranteed stress reliever. We save for these budget categories and others monthly using this method combined with something we've been doing for a few years: At the beginning of the year, I typically get a raise and a bonus. Which is awesome! So, we usually take that money and see how many of these categories we can fund 100% at the beginning of the year. This lowers our amount needed on a monthly basis to fund those items, giving us more disposable income each month. We also do the same thing with extra monthly paychecks and our tax return, if we get one.

How do you save for irregular expenses?

See also: Our 2013 Financial Forecast