When, How and Why to Check Your Credit Report

Have you ever checked your credit report? To be completely honest, we checked ours when we were going through Financial Peace University but have not checked it since. Your credit score is based on how much money you borrow against your lines of credit and then how you manage paying back those debts. Except for borrowing money from family to buy a Jeep, we haven't taken out a loan in more than four years (our mortgage), and we no longer are paying on any loans except that mortgage. If you step back and think about the credit score, it's only needed if you are going to be taking out a loan. Since we have taken FPU, we have no interest in taking out a loan -- besides a mortgage -- ever again, and because we haven't been paying on any debts for almost a year now (because we don't have any), we know that our credit score will not look good.

>> Have no fear, there is this thing called manual underwriting where they actually look at your entire financial situation versus just pulling your credit debt score. When that time comes and you are worried about the bank taking care of you, try Churchill Mortgage, uncle Dave recommends them.

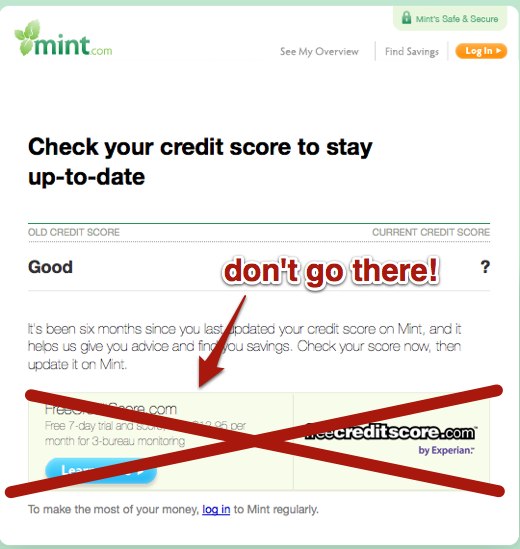

So, as I said, pulling our credit report is something that we have neglected to do over recent years, but I got this email from mint.com a few weeks ago that nudged me into doing this again.

But, before you just get your credit report from any website (even if they have really clever commercials) that will then send you junk mail and make you enroll in some program, let's dive a little deeper into the when, how and why you should check your credit report.

- When: You can (free of charge) and should check your credit report once a year.

- How: Go to Annual Credit Report to get a copy of your credit report from all three of the agencies: Equifax, Experian and TransUnion.

- Why: The reason to check your report every year shouldn't be as a measure of how your debt score is moving, but rather it should be to ensure that it is accurate. Dave states that 79 percent of all credit reports contain some kind of error. There may be accounts on there you never opened or don't know about, or it may remind you to cancel a store credit account that you don't need or want. He also has some great information on how to read your credit report once you get it.

I just requested and reviewed my credit report in under 10 minutes. Give it a try!

We are definitely not experts on this subject and haven't come across any road blocks by not having credit cards or small loans. What are your thoughts on the credit score system?