Real Money Talk: That Time We Over-Saved on Property Taxes

I'm telling you... budgeting is fun! Especially when you mess up (in a good way). A few weeks ago, I was getting ready to make our semi-annual property tax payment. I think it's different in every state, but in Iowa, we pay them in March and September. Without proper budgeting, this could be a nightmare, especially considering that three out of three humans in our house have birthdays in March and September. Having enough going on already, if we weren't saving for taxes on a monthly basis, we wouldn't have enough money to pay our taxes.

Note: The bank that holds our mortgage doesn't pay our property taxes or our homeowner's insurance through escrow. They simply don't offer that service, so we have to save for those two items every month. Most mortgage companies offer escrow.

This is an example of how easy YNAB makes it to save money every month. I've loved this feature since we started using the software, and in this case, it gave us an unintended bonus due to a miscalculation made by yours truly.

When I went to pay the property taxes, I realized that we not only had enough money to pay them, but we also had $997 left over in that budget category. WIN!

What Happened?

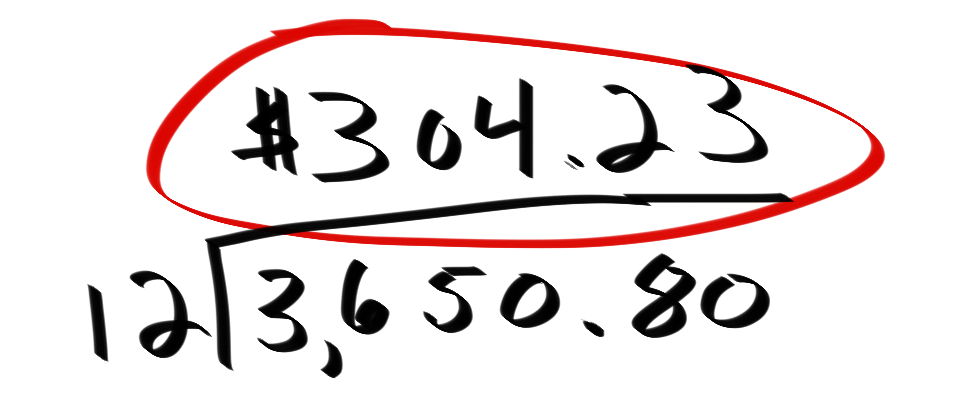

Here's the simple math of what we should have been saving per month. Our yearly property taxes are $3,680.50. (Excuse my horrible hand-writing)

I think when we received our tax bill last year, they must have increased and we happened to be short a little bit, so I adjusted the budget category to cover the difference for the few months we had left before the payment was due.

After the payment was made, I forgot to readjust the monthly budget number back down in a true "set it and forget it" fashion. Here's how much extra we were saving per month...

And since YNAB automatically adds to your total budgeted in that category, the surplus kept growing and growing. Shame on me for not keeping a closer eye on it, but it sure was a great mistake to find!

What to do with the extra money?

I came up with a few options and ways we could have handled this budgeting snafu.

- We could drastically reduce the amount we needed to save every month until the next payment was due, being able to use that extra money every month for something else. (Then we would have to remember to increase that budget category savings in September.)

- We could take that budget category down to zero (spending that money on something else or moving it to another category) after paying the taxes for March and then start saving a new amount for the next six months.

We went with option two. I didn't like the thought of possibly forgetting to increase the budget amount in September after having that nice breathing room for so long. I could go into the September budget and put a number in now I suppose, but either way it would feel as though we had less money this fall because our expenses would be increasing that month.

Nobody likes paying taxes, which is why mentally I like to put it on autopilot so I don't have to think about it. Property taxes are our third largest expense every month next to our mortgage and tithing.

After we decided how to handle the property tax category itself and make sure it was set up correctly for the future, we could move on to the fun part. What to do with the extra money?!!!

We went back to our 2014 financial forecast to see what we still had left on our list. This is how we like to "spend" large sums of money. It gives us a sense of security to know that things we want to do or how we want to spend money on later in the year are already funded. And it allows us to free up more cash on a monthly basis that we can spend on things we want... like finishing our basement.

Left on our financial forecast

- Christmas: Total $700, or $63/month until November

- Christmas cards: Total $200, or $18/month until November

These two categories were left because of they wouldn't be needed until November. But, we were able to take our extra tax savings and fully fund both our Christmas and Christmas card funds.

We had $997 extra: $574 went to Christmas and $164 went to Christmas cards, leaving us with $259. Sure... not near as exciting as moving the needle on our finish basement goal by $997, but here's the cool part...

We now have an extra $112.60/month that we can save toward the basement or other things that come up. That feels pretty good!

Takeaway

Putting your budget on autopilot reduces a lot of stress, but it's also good to check in on it every once in a while, especially looking into your monthly bills or budget billing payments that might change.

And in my research to figure out how to pay my bill online (and because I somehow misplaced the hard copy they sent us in the mail...), I found that our property taxes are estimated and we should get our fall 2014/spring2015 tax invoice sometime in July. So, that will be when I need to recalculate and adjust our monthly savings accordingly.

Have you ever found extra money in your budget? What did you do with it?