Tracking Net Worth With Off-Budget Accounts in YNAB

When we decided to give YNAB a try back in May 2013, we went with the bare bones. Previously we'd been using a spreadsheet to keep track of our budget, and although it had worked great for a few years, it didn't seem as sophisticated, and there was still a large manual element to the whole process on a monthly basis. Enter YNAB on its white horse to the rescue. I instantly fell in love with the automation of it. As we set up our first month's budget in YNAB, we started applying Rule Four and also set up a dozen or so scheduled transactions to handle our fixed monthly bills. Then, we spent the first month just making sure that everything was set up and functioning properly.

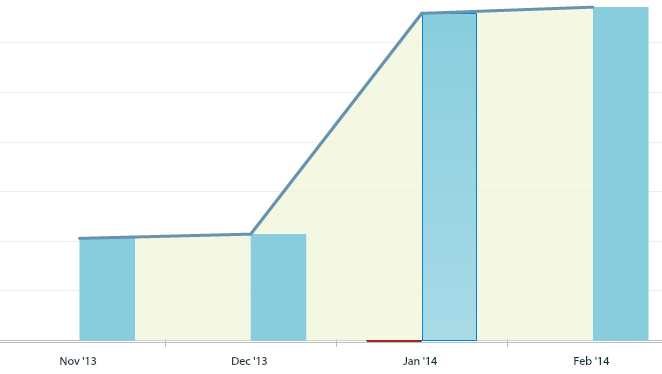

A few months later, things were working smoothly and I became a bigger and bigger fan of YNAB. But as it drew close to the end of the year, I wanted to do a financial review of all of our accounts - to take our temperature and see how we were doing in terms of net worth.

Previously I've use Mint.com for something like this because you can log in to all of your accounts and it pulls all of your assets together minus your liabilities and spits out a net worth. The problem is, every time I log into Mint, there are sync errors with half of my accounts and I have to reconnect them, and even after all of that hassle, it still hasn't synced properly for months. That's when I decided to scan the YNAB Forum for some help.

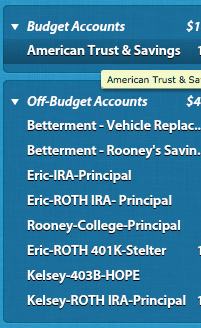

I knew YNAB had a net worth report, but I previously hadn't paid much attention to it. Again, in the beginning I was just trying to get acclimated with the software and keep it simple by automating as much as I could. But in the Forum, I found a helpful post about using off-budget accounts to keep track of retirement funds.

Setting Up Off-Budget Accounts in YNAB to Track Net Worth

Off-budget accounts are simply accounts you don't spend from.

Until now, we have been "spending money" from our budget on a monthly basis when we send money from the budget to Roth IRAs (This is how the software see it). That money leaves our budget and ends up decreasing our net worth, when in fact these categories are helping to increase our net worth. But I was telling YNAB that the money was leaving my account and I didn't have a place to show where it was going.

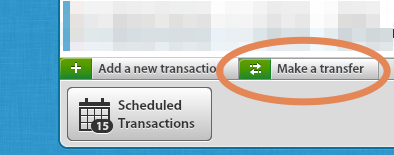

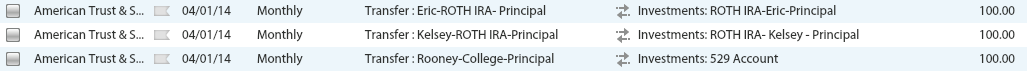

Enter the off-budget account. By setting up our IRAs as off-budget investment accounts, I was able to enter the balance as it is today and then set up a monthly transfer between our checking account and IRA (off-budget) instead of a monthly transaction.

Now, every month when money leaves the budget in our "investments" category, it gets added to the appropriate off-budget investment account and increases our net worth! Woohoo!

The next step is to periodically adjust the balance in our off-budget accounts based on the return we've gotten on our investment. We can do this by making a transaction for the difference for each account (hopefully an inflow). And we can do this as often as we would like. Since our off-budget accounts are long-term investments, I'll likely only adjust them quarterly at most.

I didn't include our home mortgage or home value in our net worth because I just wanted to keep it simple. After doing some research it seemed more conservative to exclude it.

How about you? Do you track your net worth in YNAB? Does it keep you motivated toward your financial goals?